individual income tax malaysia

Income tax is tax imposed on income from employment business dividends rents royalties pensions and. If this is the first time youre filing your taxes or you just need a clear guide on how to do the e-filling LHDN 2021.

St Partners Plt Chartered Accountants Malaysia Individual Income Tax Rate For Ya 2 0 2 0 Facebook

On the First 35000 Next 15000.

. Inheritance estate and gift taxes. There are no inheritance estate or gift taxes in Malaysia. 13 rows A non-resident individual is taxed at a flat rate of 30 on total taxable income.

Income Tax in Malaysia in 2022. Based on this amount the income tax to pay the government is RM1640 at a rate of 8. Those who stay less than that are non-residents and will be taxed differently.

Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai Cyber 8 63000 Cyberjaya Selangor. This income tax calculator can help estimate your average income tax rate and your take home pay. On the First 5000.

Both residents and non-residents are taxed on income accruing in or derived from Malaysia. For further information consult the dedicated page on the official website of the Inland Revenue Board of Malaysia. On the First 5000 Next 15000.

Headquarters of Inland Revenue Board Of Malaysia. Generally an individual who is in Malaysia for a period or periods amounting to 182 days or more in a calendar year will be regarded as a tax resident. The individual income tax has been reduced from 14 to 13 percent for resident taxpayers in the 50000 ringgit US12375 to 70000 ringgit band US17325.

Malaysia Personal Income Tax Calculator for YA 2020 Malaysia adopts a progressive income tax rate system. Resident individuals are taxed. An employee is taxed on employment income earned for work performed in Malaysia regardless of where.

Foreign income remitted into Malaysia is exempted from tax. Other income received by individuals companies cooperatives associations and others in a year. Based on this amount your tax rate is 8 and the total income tax that you must pay amounts to RM1640 RM600 RM1040.

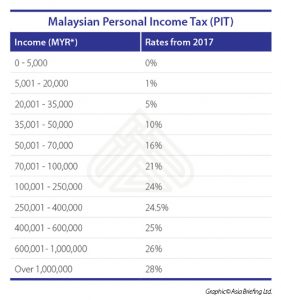

Property tax is levied on the gross annual value of property as determined by. At the time of writing personal income tax for Malaysian tax residents is progressive from 1 - 30 depending on income level. Calculations RM Rate TaxRM A.

This means that low-income earners are imposed with a lower tax rate compared to those with a higher income. Malaysian tax residents - what income is taxable. However in this article well be solely focusing on Malaysia Personal Individual Income Tax YA2021 that is tax paid by employees in Malaysia.

1 Individual and dependent relatives. Individuals who earn an annual employment income of more than RM34000 and has a Monthly tax Deduction MTD is eligible to be taxed. However if you claimed RM13500 in tax deductions and tax reliefs your chargeable income will be reduced to RM34500.

Here are the full details of all the tax reliefs that you can claim for YA 2021. On the First 20000 Next 15000. The personal income tax rate in Malaysia is progressive and ranges from 0 to 30 depending on your income for residents while non-residents are taxed at a flat rate of around 30.

2 Medical treatment special needs and carer expenses for parents. Income tax shall be charged for each year of assessment upon the income of any person accruing in or derived from Malaysia or received in Malaysia from outside Malaysia. On the First 50000 Next 20000.

Information on Taxes in Malaysia Malaysia has implementing territorial tax system. Tax rates in Malaysia The Malaysian 2020 budget raised the maximum tax rate an individual could pay to 30 percent from 28 percent for chargeable income exceeding 2 million ringgit US489 thousand. The IRBM has provided various payment channels via electronic ByrHASiL with appointed banks.

Introduction Individual Income Tax. Also taxes such as estate duties earnings tax yearly wealth taxed or federal taxes do not get levied in Malaysia. There are no net wealthworth taxes in Malaysia.

An individual whose total taxable income EXCEEDS the threshold value must register for an income tax file. The system is thus based on the taxpayers ability to pay. The scope of individual taxation depends on his residency status.

Resident status is determined by reference to the number of days an individual is present in Malaysia. Capital gains on disposals of real properties are subject to RPGT see the Other taxes section. Granted automatically to an individual for themselves and their dependents.

The calculation of individual threshold of non taxable income is taking into account after the deduction of annual gross income with eligible individual reliefs and tax rebates. The personal income tax with the highest rate is only 27. The non-resident tax rate in Malaysia is a flat rate of 30 on all taxable income².

The Income tax rates and personal allowances in Malaysia are updated annually with new tax tables published for Resident and Non-resident taxpayers. The Tax tables below include the tax rates thresholds and allowances included in the Malaysia Tax Calculator 2022. However if you claimed RM13500 in tax deductions and tax reliefs your chargeable income would reduce to RM34500.

Individual - Income determination Employment income. Under the tax law those who stay more than 182 days in Malaysia are considered residents. Malaysias government has introduced several income tax amendments that will impact individual taxpayers for 2021.

Download Kwsp Income Tax Relief 2019 Gif Kwspblogs

Malaysia Personal Income Tax Rates Table 2010 Tax Updates Budget Business News

Cover Story Budget 2020 Top Tax Bracket Raised To 30 Tin Number Proposed The Edge Markets

Cukai Pendapatan How To File Income Tax In Malaysia

The Complete Income Tax Guide 2022

Income Tax Calculator 2021 Malaysia Personal Tax Relief Malaysia Tax Rate

7 Tips To File Malaysian Income Tax For Beginners

Individual Income Tax In Malaysia For Expatriates

Income Tax Malaysia 2018 Mypf My

St Partners Plt Chartered Accountants Malaysia Personal Income Tax Rate For Ya 2020 2020年个人所得税税率 Facebook

Malaysian Tax Issues For Expats Activpayroll

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Malaysia Personal Income Tax Rates 2013 Tax Updates Budget Business News

Income Tax Malaysia 2019 Calculator Madalynngwf

Malaysian Personal Income Tax Pit 1 Asean Business News

Individual Income Tax Malaysia Georgiartl

Malaysia Personal Income Tax Rates Table 2011 Tax Updates Budget Business News

Comments

Post a Comment