sole proprietorship income tax calculator malaysia

A sole proprietorship also known as sole trader is a form of business operated by one individual. A sole proprietor pays income tax on the net income profits of the business NOT on the money the sole proprietor takes out of the business as a draw.

Income Tax Malaysia 2018 Mypf My

It is computed by subtracting their wages bonuses and interest payments from the.

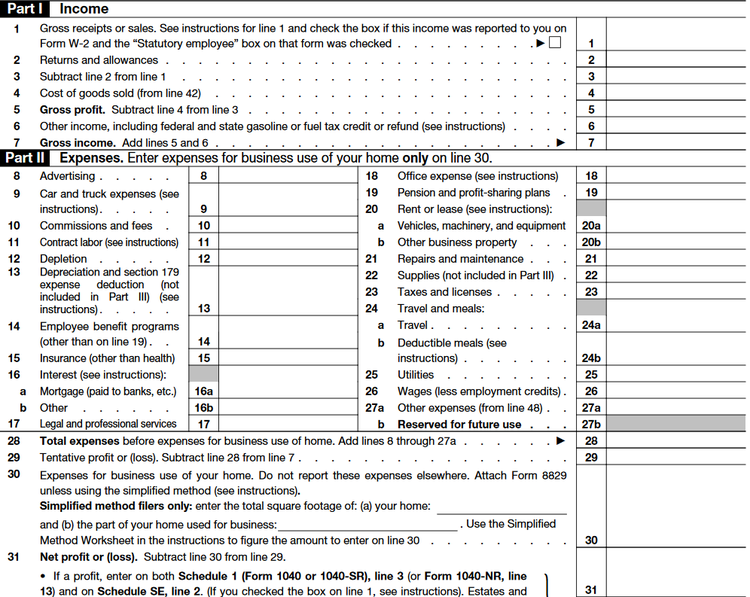

. Calculations RM Rate TaxRM A. As we explained as a sole proprietor youll report and pay income tax on your businesss profitand youll do so by filing additional forms with your personal return Form. Resident company with a paid-up capital of RM 25.

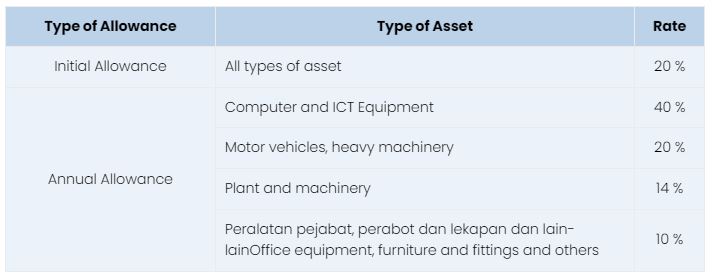

Owning a sole proprietorship gives the owner entire control and decision-making authority over the. Companies are taxed at the 24 with effect from Year of Assessment 2016 while small-scale companies with paid-up capital not exceeding RM25 million are taxed as follows. Your business profit is calculated and.

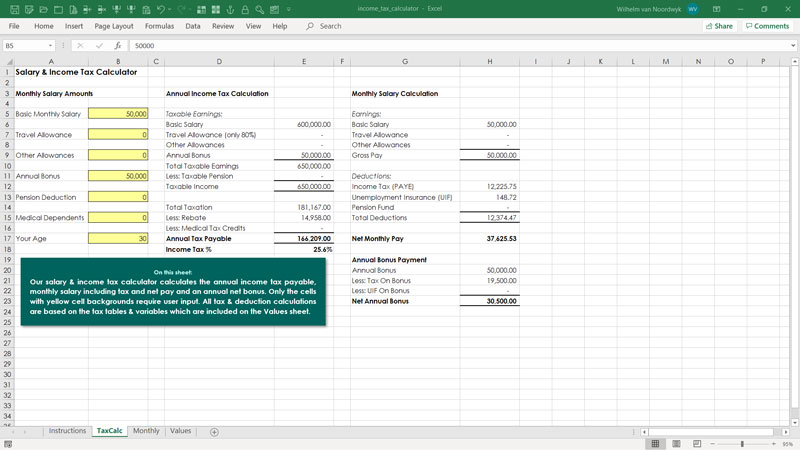

Simply input your data and it will automatically calculate your tax payable amount. The calculator will calculate taxes for company so that you can determine how to plan your companys cash flow. Paying Taxes An.

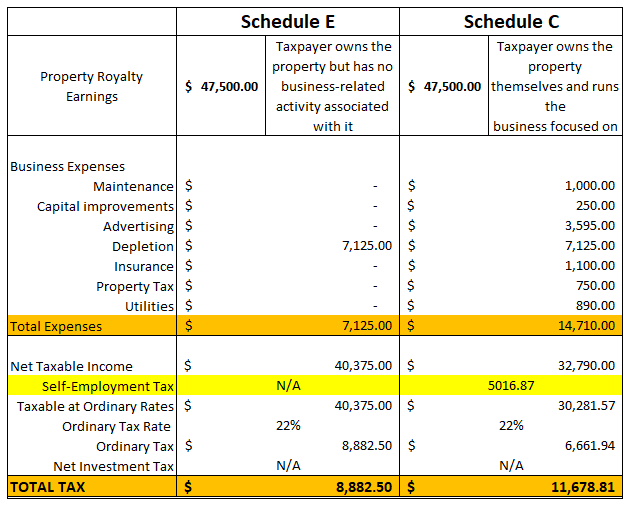

Foreign-sourced income taxed upon remittance into Malaysia. Divisible Income Second we would calculate divisible income for Ben and Jerry from Fitstar. However if you claimed RM13500 in tax deductions and tax reliefs your chargeable income will be reduced to RM34500.

The standard corporate income tax rate in Malaysia is 24. Additional deduction of MYR 1000 for YA 2020 to 2023 increased maximum to MYR 3000. Special relief for domestic travelling expenses until YA 2022.

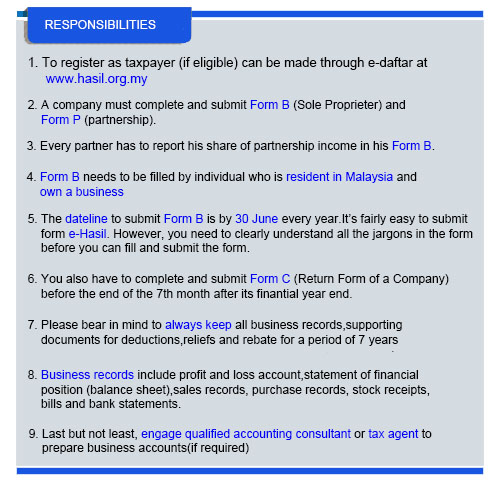

Do note that the final. Here are some of the primary benefits of setting up a sole proprietorship in Malaysia. What is Sole Proprietorship Starting A Business Under Sole Proprietorship.

Register your LLP for a Tax File at a nearby LHDN branch. You can now estimate your yearly company using the calculator below. Use Form CP 600PT.

There are a few income tax calculator in Malaysia but my favourite is KiraCukaimy. This enables you to drop down a tax bracket lower your. Youll also need to submit copies of your LLP certificate from Step 1 and stamped LLP.

On the First 5000 Next 15000. Individuals who earn an annual employment income of more than RM34000 and has a Monthly tax Deduction MTD is eligible to be taxed. On the First 5000.

How Sole Proprietors Pay Income Tax. The calculation of individual threshold of non. Other corporate tax rates include the following.

The tax on business income of the sole proprietor is payable on a six-instalment basis based on an estimated tax provided by the tax authorities. In the case of the company or. All foreign-sourced income of all Malaysian tax residents individuals who carry on business through a partnership.

A sole proprietorship is taxed through the personal tax return of the owner via Form 1040.

Sole Proprietor Tax Forms Everything You Ll Need In 2022

Royalty Income Taxes For 2020 With Filling Procedures Taxhub

Malaysia Personal Income Tax Rate Tax Rate In Malaysia

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

This Income Tax Calculator Shows What You Owe Lhdn Ringgit Oh Ringgit

Taxable Income Formula Calculator Examples With Excel Template

How To File Income Tax For Your Side Business

This Income Tax Calculator Shows What You Owe Lhdn Ringgit Oh Ringgit

Tax Computation Template And Techniques For Partnership And Sole Proprietorship Hk Account Q A

What Bloggers Influencers And Freelancers Need To Know About Taxes In Malaysia Blogjunkie Net

Taxable Income Formula Calculator Examples With Excel Template

Tax Computation Template And Techniques For Partnership And Sole Proprietorship Hk Account Q A

Format Computation 1 Xlsx Computation Of Chargeable Income Tax For Ya Xxxx Husband Wife S 4 A Business Income Adjusted Income Add Balancing Course Hero

15 Tax Deductions You Should Know E Filing Guidance Financetwitter

Income Tax Return Personal Tax Sole Proprietor Partnership Company Shopee Malaysia

Understanding Tax Smeinfo Portal

Computation Of Income Tax In Excel Excel Skills

Comments

Post a Comment